Unlocking financial health

BrightAnalytics helps businesses understand their financial data. In this guide, we focus on three key indicators: solvency, liquidity, and profitability. These metrics provide valuable insights into your company’s performance and help you make better decisions for long-term growth. To get the full picture, always compare your results with industry averages and your own historical data.

Understanding Financial Ratios: A Comprehensive Guide

Knowing your company’s financial health is essential. Financial ratios help you understand different aspects of your business. This guide focuses on three key categories: solvency, liquidity, and profitability.

Keep in mind: ratios are most useful when compared to industry standards and your company’s historical data. Looking at them in context gives a fuller, more accurate picture of performance.

1. Solvency: assessing long-term stability

Solvency ratios show whether your company can meet its long-term obligations. Key metrics include:

- Equity Ratio:Proportion of assets financed by shareholders’ equity. A higher ratio indicates financial strength.

- Equity to Debt Ratio:Compares equity to debt, highlighting your capital structure.

- Retained Earnings Ratio: Measures how much of the company’s assets are funded by retained profits.

- Debt Coverage Ratio: Shows the ability to pay debts using operating cash flow.

- Debt Ratio: Percentage of assets financed by debt.

- Operating Cashflow Ratio:Evaluates your capacity to cover short-term debts with operating cash flow.

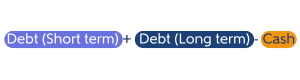

- Net Financial Debt:Total debt minus cash and equivalents, reflecting overall indebtedness.

- Interest Coverage Ratio: Ability to meet interest payments from operating income. A higher ratio indicates lower default risk.

2. Liquidity

Liquidity ratios measure your ability to cover short-term debts. Important metrics:

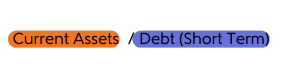

- Current Ratio: Compares current assets to current liabilities. Above 1 indicates good liquidity.

- Days Sales Outstanding (DSO): Average time to collect payments from customers. Lower DSO = faster cash collection.

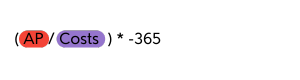

- Days Payable Outstanding (DPO): Average time to pay suppliers. Higher DPO preserves cash but may affect creditworthiness.

- Days Inventory Outstanding (DIO): Average time to sell inventory. Lower DIO indicates efficient inventory management.

- Cash Conversion Cycle (CCC): Time to turn investments in inventory and receivables into cash (CCC = DIO + DSO – DPO).

- Net working capital (NWC): Current assets minus current liabilities; shows available capital for daily operations.

- Cash Ratio: Ability to pay short-term liabilities with cash and equivalents.

- Quick Ratio:Similar to current ratio but excludes inventory for a focus on liquid assets.

- FCF: Cash generated from operations available for investors, debt reduction, or reinvestment.

3. Profitability

Profitability ratios assess how well your company generates profit. Key indicators include:

- EBITDA Margin: EBITDA as a percentage of turnover. Higher margin = better cost management and profitability.

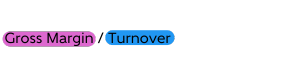

- Gross Profit Margin: Percentage of sales revenue remaining after deducting COGS. Measures efficiency of core operations.

- Return on Equity (RoE): Efficiency in using equity to generate profits. Higher RoE = better returns for shareholders.

- Profitability / Total Liabilities: Ability of profits to cover total financial obligations. Higher value = lower financial risk.